Forward Contract

Forward contracts are used by clients who wish to fix their exchange rates for a select period of time without having to commit cash flow to buying currency in advance. Forward Contracts help protect your business against the risk of market fluctuations. Deposits can be required depending on value amount booked or the number of year / months you take out the Forward Contract for.

What is a Forward Contract?

A Forward Contract is booking the currency you need at the current market rate with a later settlement date. You are able to book the full amount of currency you need at today’s rate without having to pay for the trade until you need the currency sent out. Forward Contracts are used as a risk management solution that allows businesses and individuals to secure an exchange rate today to complete the money transfer at a specific date within 12 months. This reduces their currency risk if the exchange rate were to fall within that period and gives them an exact cost for the money transfer.

Benefits:

Booking forward contracts helps you fix the cost of your future international payment, allowing you to plan ahead with reassurance and certainty. If the current rate is favourable to you or your business, you can lock the rate on any figure you wish for a selected time. This means that if the exchanging rate drops, you will still receive the forward exchange rate you locked in at on any of your future payments.

See our case study on the right for example.

Client Example:

Medical Company Buying Goods From A Supplier In 3 Months

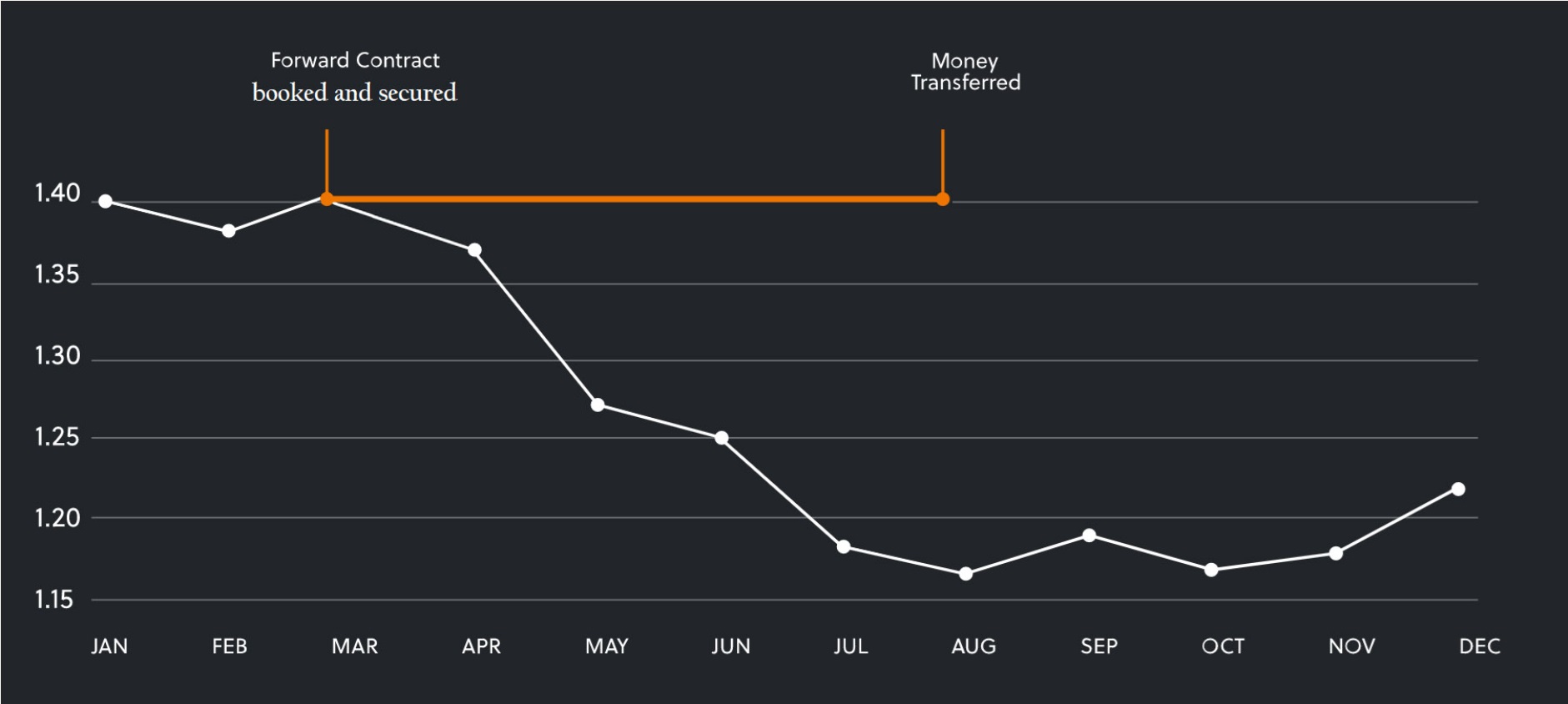

A medical company has agreed a contract of $200,000 USD worth of goods from their supplier in the next 3 months. To protect against currency fluctuations and uncertainty in GBP/USD movements, the medical company decides to book the $200,000 USD needed in 3 months at the current market price for GBP/USD that was trading at 1.40 for a 3 month Forward Contract.

- GBP/USD was trading at GBP/USD: 1.40

- Client Sold: £142,857.14 GBP

- Client Bought: $200,000.00 USD

The medical company now have the above figures fixed and secured. So even if the exchange rate for GBP/USD drops back to a lower level across the next 3 months when this medical company need to send USD to their supplier, they can decide to use their forward rate (1.40) or current market spot rate.

So not only did this Forward Contract reduce their exposure to the risk of any currency movements, the client also had $200,000 USD booked without effecting any cash flow within their business until the settlement date in 3 months whilst securing the profits on their products 3 months before.

Frequently Asked Questions

Find answers to common questions about Forward Contract.

Are there any fees or charges to Forward Contracts?

Are there any fees or charges to Forward Contracts?

You can book a Forward Contract for up to 24 months. Deposits may be required depending on value amount booked or the length of the period you book it for.

How long can I book a Forward Contract for?

How long can I book a Forward Contract for?

You can book a Forward Contract for up to 24 months. Deposits may be required depending on value amount booked or the length of the period you book it for.

Ready to Get Started?

Contact our team today to learn more about how Forward Contract can benefit you.